Our advisory on COVID recommended you cover all employees with quality health coverage. Now the Ministry of Home Affairs, Government of India has passed guidelines making it mandatory to provide employees with health insurance for companies operating during the lockdown. We have partnered with Antworks to provide our members with Group health insurance and COVID-19/Corona Virus plans. You can join through our website or send an email to support@policysecure.in.

Please Contact Us with any query.

Our website details the benefits of this program.

The world is battling with this infection. We hope everyone is taking the required precautions and SIA has already shared an advisory on managing yourself and your business in these trying times. We request you to take care of your employees also and have worked with our insurance experts at Antworks to give you a plan specifically for COVID-19.

Along with the Group Health plan, this is another option to cover your employees and their families with quality care in case of hospitalization because of the Corona Virus.

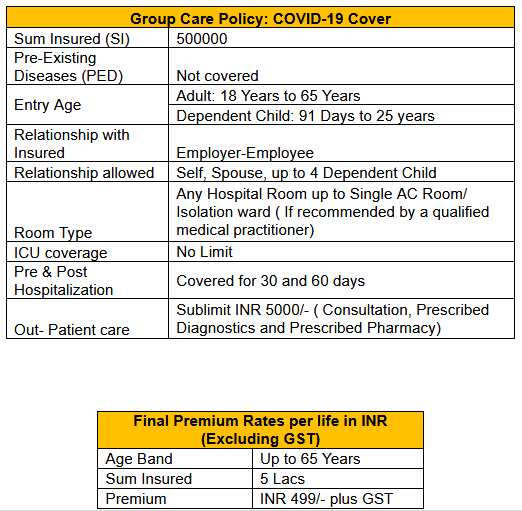

Included are the details of the plan –

Our website details the benefits of this program.

Start up companies and their employees are not in a position to get favourable Insurance services from Insurance companies due to their smaller size and lack of experienced personnel to handle the insurance portfolio. In order to help the Start up companies to overcome this problem, we have tied up with Max Bupa Health Insurance to provide Group Health cover to all employees of SIA members.

The details of cover are as follows:

Start up India Association is a registered association which has been formed for promoting interests of all entities doing business in the Indian start up ecosystem. SIA, based in Delhi, was formed in 2016 and has more than 1700 active members. You can get more information about the Association at www.startupindiaassociation.com

Antworks Insurance Broking is an IRDA registered Insurance Broker. (license no. 481). Antworks Insurance Broking has launched its online portal www.policysecure.in